Executive Summary

The debasement trade dominated 2025 with results that should force a reassessment of crypto's place in macro portfolios.

Gold posted its strongest year since 1979, gaining 65% to close near $4,310 per ounce, then extended gains into January 2026 by breaking above $5,000 for the first time.

Silver did even better, surging 140% to $72 per ounce for its best performance in 46 years, then accelerating further in January 2026 with a parabolic move above $110 driven by physical demand and inventory tightness.

Meanwhile, Bitcoin fell 6.3% in 2025 and has barely moved in January, despite sharing the same monetary debasement thesis that supposedly underpins its value proposition.

This divergence reveals something important: the "digital gold" narrative broke down precisely when it should have worked. The Fed resumed balance sheet expansion. Fiscal deficits hit new records. The dollar had its worst year since 2017, falling 9.6% on the DXY index.

Every condition that Bitcoin bulls cite as bullish for their asset materialized in 2025, and Bitcoin still underperformed cash. In January 2026, precious metals accelerated higher while Bitcoin continued to flatline, widening the divergence further.

Before drawing conclusions, however, an important framing question must be addressed.

The "digital gold" label may be a strawman. Sophisticated Bitcoin proponents increasingly argue the asset is not a substitute for gold's day-to-day safe-haven function but rather a hedge against tail-risk monetary regime change: currency crises, capital controls, sovereign failures.

If that framing is correct, Bitcoin did not "fail" in 2025 because the conditions that would activate its value proposition (regime instability rather than garden-variety debasement) never materialized.

This analysis examines both framings. Against the "digital gold" benchmark, Bitcoin clearly underperformed. Against the "regime change insurance" benchmark, the jury remains out because 2025 did not stress-test that thesis.

The question for 2026 is which framing proves correct, and whether the nature of debasement shifts in ways that favor one asset class over the other.

The Setup: Why 2025 Should Have Been Bitcoin's Year

What Is the Debasement Trade?

The debasement trade refers to positioning in assets that preserve purchasing power when central banks expand money supply through balance sheet expansion (direct monetary creation), persistent fiscal deficits (government debt monetization), and currency devaluation (competitive debasement among nations).

Traditional beneficiaries include gold, silver, commodities, and inflation-protected securities. Bitcoin was supposed to join this list as "digital gold."

The Catalyst: Fed's Return to Balance Sheet Expansion

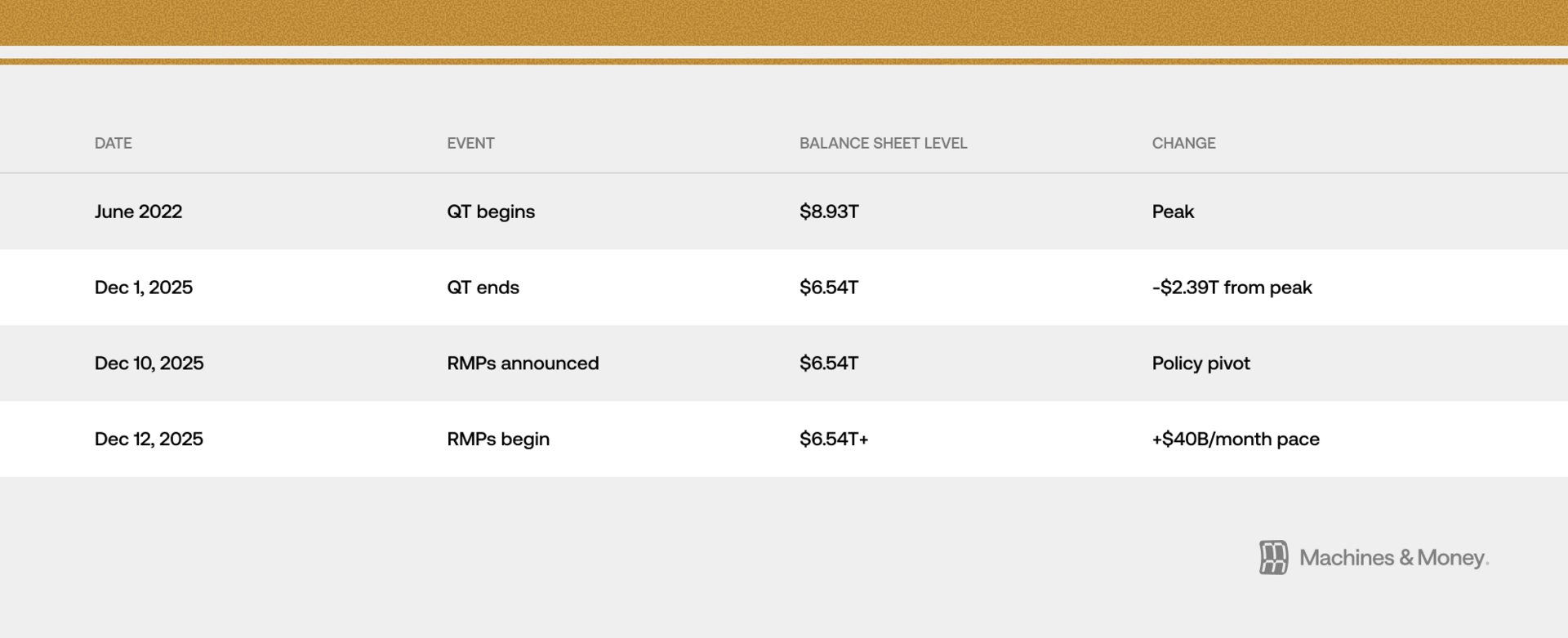

On December 10, 2025, the Federal Reserve announced it would begin purchasing Treasury securities at $40 billion per month, starting December 12.

The Fed calls these "reserve management purchases" rather than QE, but the mechanical effect is identical: expanding the monetary base while inflation sits at 3%, still above the 2% target.

The Fed justified this as a technical adjustment to maintain "ample reserves" after repo market stress emerged in autumn 2025. Skeptics note that purchasing $40 billion monthly in Treasuries while running trillion-dollar deficits looks a lot like deficit monetization regardless of what you call it.

Fiscal Backdrop

The fiscal situation provides the structural foundation for the debasement thesis.

U.S. federal net interest costs exceeded $1 trillion annually for the first time in FY 2025 (CRFB, Peterson Foundation). Debt-to-GDP sits north of 100%. The Congressional Budget Office projects deficits averaging $2 trillion annually through the end of the decade.

This is not a U.S.-specific phenomenon. Governments globally are running massive and persistent deficits, creating coordinated debasement pressure across major currencies.

The combination of resumed monetary expansion and deteriorating fiscal trajectories creates textbook conditions for hard asset outperformance.

The Winners: How Gold and Silver Captured the Trade

Gold's Record-Breaking Rally

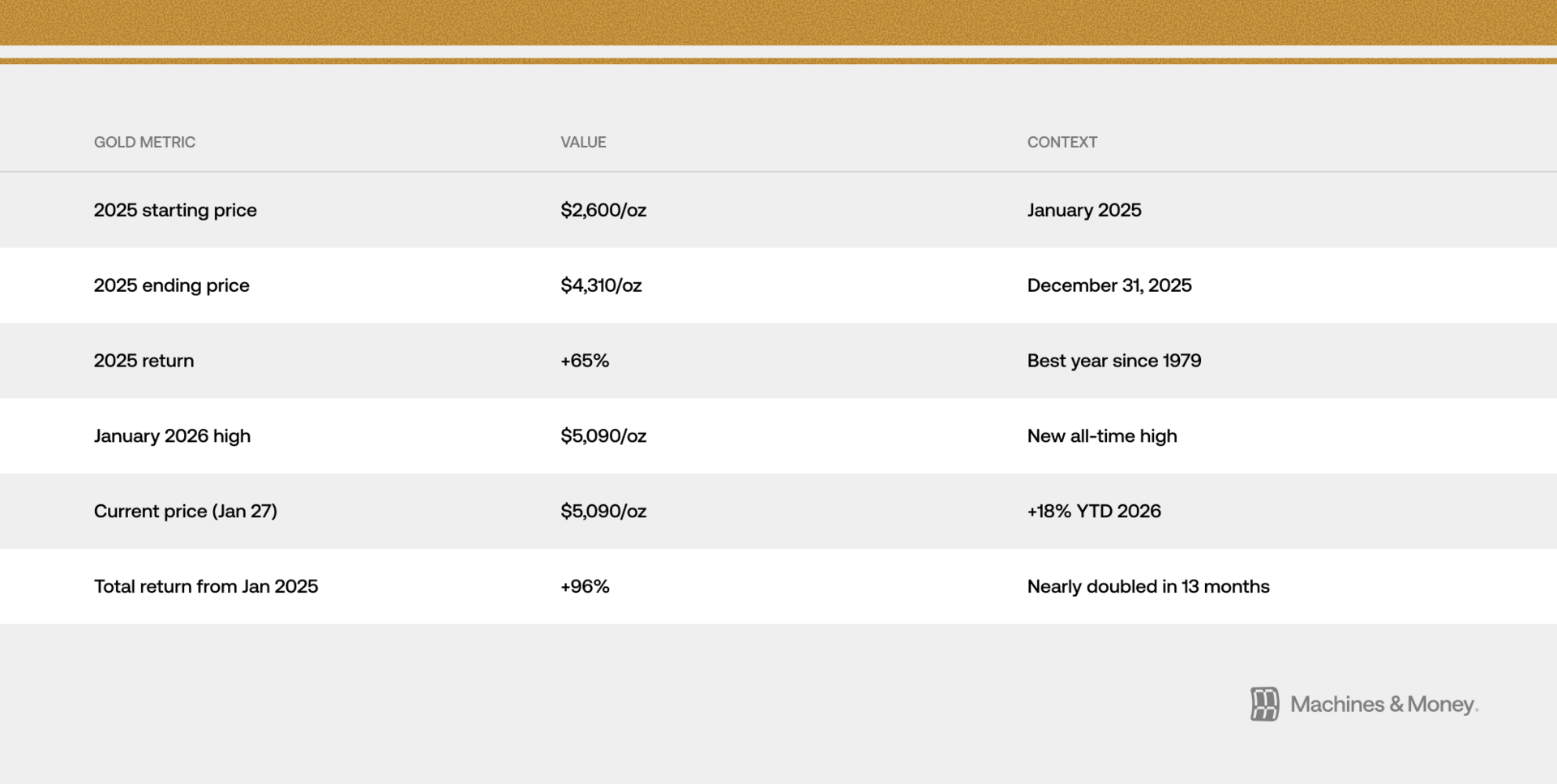

Gold started 2025 at approximately $2,600 per ounce and finished near $4,310, a gain of 65% that marks its strongest annual performance since 1979.

The metal set 45 all-time highs through October 8, continuing to set additional records through year-end for a total exceeding 50 (World Gold Council).

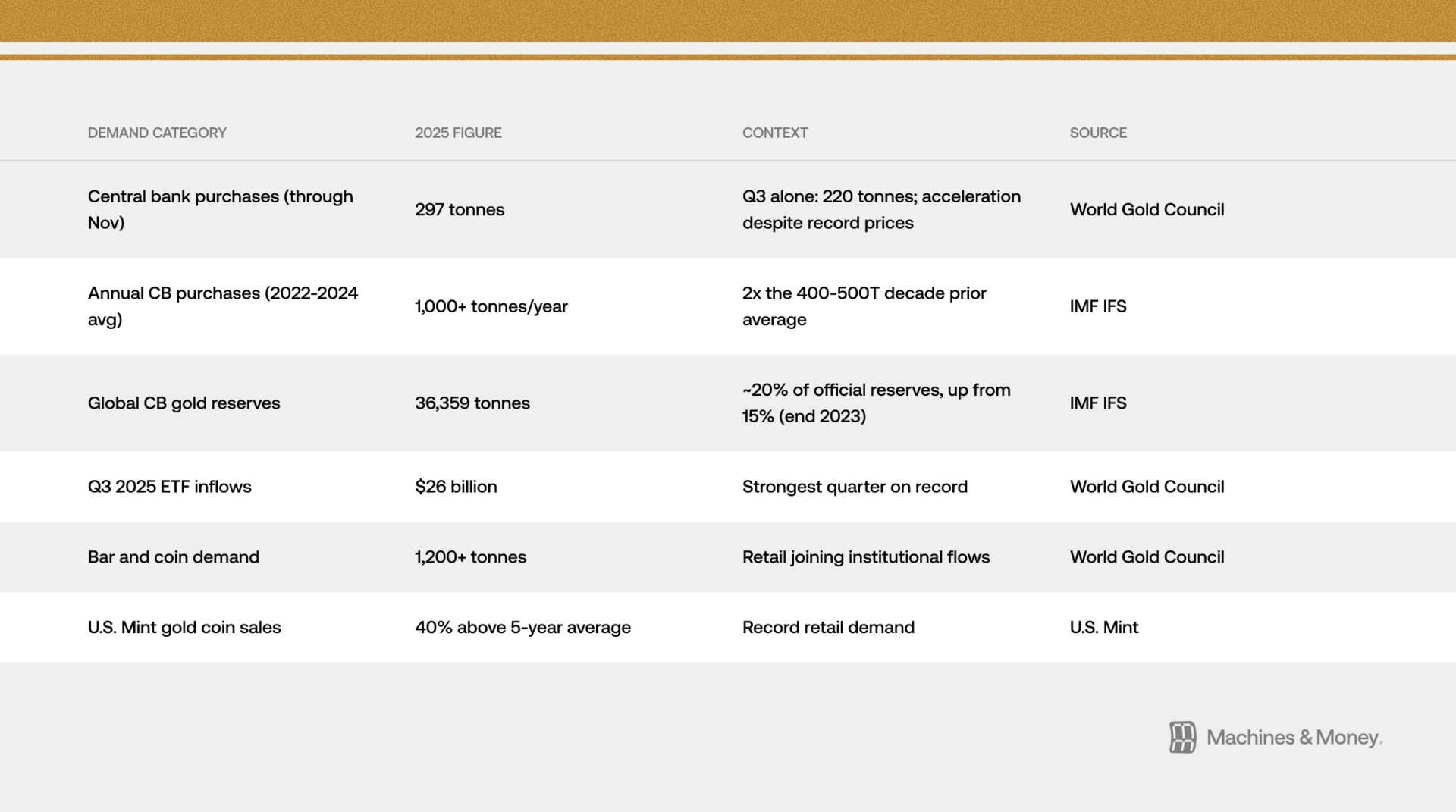

Central bank accumulation remained the structural driver. When the People's Bank of China, the National Bank of Poland, and dozens of other central banks accumulate gold at record pace while prices hit all-time highs, they signal conviction that justifies paying up for the asset. This official sector validation matters for institutional portfolio construction in ways that benefit no other alternative asset.

Investment demand surged across channels. Gold ETFs recorded their strongest quarterly inflows on record in Q3 2025. Bar and coin demand exceeded 1,200 tonnes for the year. Major online dealers including APMEX and JM Bullion reported record traffic and sales volumes. The Perth Mint saw its highest retail demand since 2020.

Rate cut expectations supported valuations throughout the year. Lower yields reduce gold's opportunity cost, and markets spent much of 2025 pricing in Fed easing that eventually materialized in December.

Geopolitical risk added a persistent bid. The Venezuela crisis, Middle East tensions, and concerns about Fed independence under political pressure all contributed to safe-haven demand.

Gold's January 2026 Acceleration

The rally did not pause for the calendar turn. Gold surged from $4,310 at year-end to above $5,000 by late January 2026, gaining 18% in less than a month. This move broke through a psychologically significant round-number barrier and suggests the debasement trade is accelerating rather than maturing.

The drivers remain the same: central bank accumulation, ETF inflows, retail demand, and persistent geopolitical uncertainty. But the pace has quickened.

Gold gaining 18% in January alone, after a 65% year, signals that institutional and sovereign buyers are not waiting for pullbacks.

They are paying up for exposure, which typically indicates strong conviction about the direction of monetary policy.

Silver's Parabolic Surge

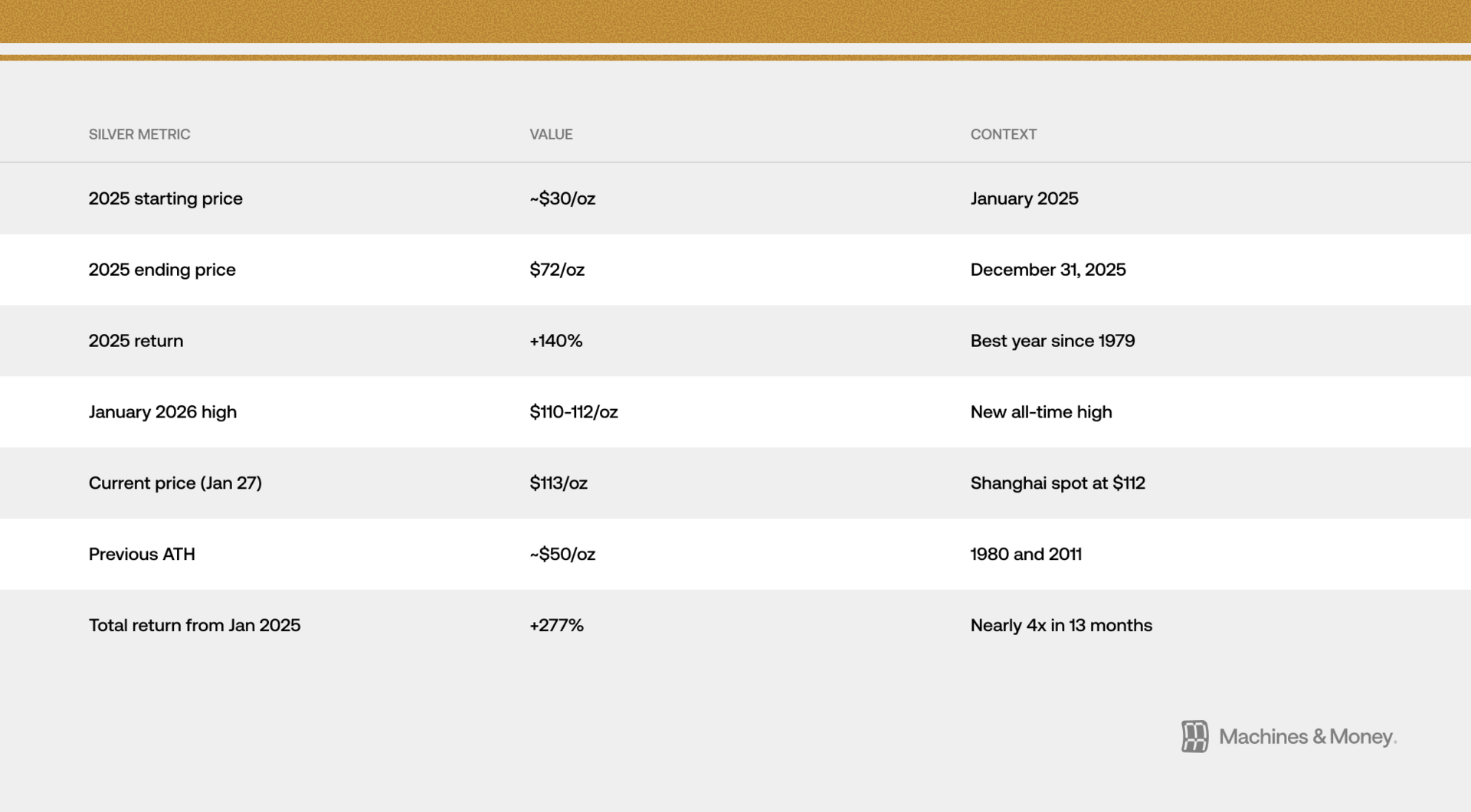

Silver's 2025 performance was extraordinary, but January 2026 turned parabolic. The metal rose 140% during 2025, from approximately $30 per ounce to $72 per ounce by year-end.

It then accelerated further in January 2026, breaking above $100 for the first time and reaching $110 to $112 in spot markets, with Shanghai silver hitting $112. As of January 27, 2026, silver trades around $113 per ounce.

The January 2026 surge reflects a physical scramble for metal. Chinese demand has intensified, with Shanghai premiums reaching extremes. Inventory levels across major exchanges have fallen to critical levels.

The rally has turned parabolic in a way that recalls 1979-1980, though without the concentrated manipulation that characterized that episode.

Silver's outperformance reflects its hybrid nature as both monetary metal and industrial commodity. Supply deficits have persisted for five consecutive years, with the market short 160 to 200 million ounces annually. Unlike gold, most silver production comes as a byproduct of other mining, meaning supply cannot respond quickly to higher prices.

Industrial demand from solar panels, electric vehicles, and AI data centers continued growing. The Silver Institute estimates industrial consumption exceeded 36,000 metric tonnes in 2025.

Mining constraints tightened supply further. Mexico, the world's largest silver producer, saw output decline 4 to 6% amid regulatory changes (GlobalData, INEGI). Russian sanctions created additional disruptions.

The gold-to-silver ratio collapsed from over 100 in early April 2025 to below 60 by year end, a dramatic reversion that reflects silver's catch-up rally after years of underperformance relative to gold. With both metals surging in January 2026, the ratio has stabilized around 45 as gold's $5,000 breakout matched silver's continued strength.

The Puzzle: Six Reasons Bitcoin Missed the Rally It Was Made For

Performance Disconnect

Bitcoin began 2025 at $93,425 and ended at $87,509, a loss of 6.3%. The cryptocurrency did hit an all-time high of $126,198 on October 6, but gave back all those gains and more in the final quarter.

As of January 27, 2026, Bitcoin trades around $87,800, essentially flat for the month while gold gained 18% and silver gained 57%.

The contrast with other assets is stark. While silver gained 140% in 2025 (now approaching 280% from January 2025 levels), gold 65% (now 96% from January 2025), the Nasdaq 20%, and the S&P 500 18%, Bitcoin posted its first negative year since 2022.

The Bitcoin-to-gold ratio tells the story of relative underperformance. In December 2024, one Bitcoin bought approximately 40 ounces of gold. By year-end 2025, that had fallen to 20 ounces.

Today it sits at 17 ounces, the lowest since early 2024, with the ratio compressing 15% in January 2026 alone as gold surged and Bitcoin stagnated. The ratio has historically ranged from 15 to 40 ounces, with a median around 25 to 30 ounces over 2023-2025.

At 17 ounces, the ratio is now approaching the 15-ounce threshold that would signal further breakdown in the monitoring framework below. During the 2022 bear market, this ratio bottomed around 9 ounces, so there may be further downside if current trends continue.

Why Bitcoin Missed the Debasement Trade

The underperformance requires explanation because the macro setup was exactly what Bitcoin bulls have been waiting for. Monetary expansion resumed. Real rates turned negative. The dollar weakened 9.6% on the year. Fiscal sustainability concerns intensified.

Every theoretical driver of Bitcoin's "digital gold" thesis came into play, yet the asset fell while actual gold soared. The divergence has only widened in January 2026.

The factors driving this divergence fall into two categories: structural factors that would predict persistent underperformance regardless of cycle, and cyclical factors that would predict temporary underperformance specific to 2025.

Distinguishing between them matters for forward-looking positioning.

Structural Factors

These factors reflect Bitcoin's fundamental properties and market structure.

They would predict continued underperformance relative to gold as a debasement hedge unless the nature of debasement itself changes.

1. Volatility as Disqualifier

For the debasement trade specifically, volatility is a bug, not a feature. Investors hedging currency debasement want stability of purchasing power. They want an asset that preserves value, not one that might double or halve in a year.

Bitcoin's annualized volatility ran approximately 52 to 54% in 2025, compared to 15 to 17% for gold (BlackRock/iShares, NYDIG). Bitcoin is roughly 3.5 times more volatile than gold.

For institutional allocators with risk budgets and drawdown limits, this math presents a fundamental problem: an asset that can easily lose more in a month than the debasement it is theoretically hedging over a year.

The irony is that Bitcoin's potential upside in a monetary crisis scenario remains higher than gold's. But the path dependency matters.

An asset that might deliver 10x returns in a dollar collapse is less useful than one that reliably preserves value if the path to that 10x includes multiple 50% drawdowns.

2. Central Bank Endorsement Gap

Central banks bought over 1,000 tonnes of gold annually for three consecutive years while purchasing exactly zero Bitcoin. This created a signaling effect beyond the direct demand impact.

When the People's Bank of China, the National Bank of Poland, and dozens of other central banks accumulate gold at record pace, they validate gold's role as a reserve asset.

This institutional endorsement matters for portfolio construction. A pension fund CIO can point to central bank behavior as justification for a gold allocation. No such justification exists for Bitcoin.

The counter-argument is that central banks were not buying Bitcoin in prior cycles either, yet Bitcoin still rallied. This is true. But in prior cycles, Bitcoin's gains came from speculation, adoption curves, and liquidity expansion, not from capturing safe-haven flows.

In 2025, the macro narrative explicitly positioned Bitcoin as a debasement hedge, and the absence of any official sector validation became more conspicuous.

3. Institutional Portfolio Mechanics

The spot Bitcoin ETF approvals of 2024 were supposed to unlock institutional capital. They did bring money into the space, with approximately $21 billion in spot Bitcoin ETF inflows during 2025 alone (cumulative inflows since January 2024 total approximately $57 billion).

But this institutional adoption created a new dynamic: Bitcoin now trades according to institutional portfolio rules rather than crypto-native dynamics.

When pension funds and registered investment advisors buy Bitcoin ETFs, they typically fill a small "alternative" or "digital assets" sleeve, perhaps 1 to 3% of a portfolio. These allocations get rebalanced quarterly.

When Bitcoin outperforms, institutions sell to maintain target weights. When risk budgets tighten across the portfolio, the small, volatile Bitcoin position gets trimmed first.

This institutional overlay dampened Bitcoin's upside capture during rallies while maintaining its downside exposure during selloffs.

The asset inherited the costs of institutional ownership without the benefits of being treated as a core holding.

Cyclical Factors

These factors are specific to 2025's market conditions and could reverse. They would predict that Bitcoin's underperformance is temporary rather than structural.

4. Risk Asset Correlation During Stress

Bitcoin in 2025 traded like a risk asset, not a safe haven. The 60-day rolling correlation between Bitcoin and the Nasdaq Composite averaged 0.4 to 0.5 during 2025, spiking to 0.7 or higher during stress periods (CME Group Research).

Gold's correlation with equities averaged near zero (0.1 to 0.2) and turned negative during major drawdowns (World Gold Council).

The mechanism is straightforward: because institutions classify Bitcoin as a speculative or alternative allocation (see structural factor 3), risk budget constraints force selling during drawdowns.

During the Q1 2025 equity drawdown (January to April), Bitcoin fell 31.7% while gold gained 33%, a 65-percentage-point divergence that starkly illustrates the different behavior during risk-off episodes (CNBC, LiteFinance, LBMA).

This factor is cyclical because correlation regimes shift. If institutions begin treating Bitcoin as a hedge rather than a speculation, the correlation structure could change. But that shift requires either a change in institutional mandates or a sustained period of Bitcoin demonstrating uncorrelated behavior, neither of which occurred in 2025.

5. The October Peak and Subsequent Grind

Bitcoin peaked at $126,198 on October 6, but the post-peak decline reflects two distinct phenomena that the market has conflated.

The initial correction from October highs represented profit-taking after a 35% rally from summer lows. This is normal cycle behavior.

The failure to recover during Q4, even as the Fed pivoted and gold accelerated higher, represents something different: Bitcoin's inability to capture safe-haven flows even when conditions favored debasement hedges.

By December, when the Fed announced balance sheet expansion, gold jumped 5% in a week while Bitcoin continued drifting lower.

The October-to-December period is the critical test case.

Every macro condition that should theoretically support Bitcoin improved during this window, yet the asset underperformed not just gold but also equities. January 2026 has extended this pattern: gold up 18%, silver up 57%, Bitcoin essentially flat.

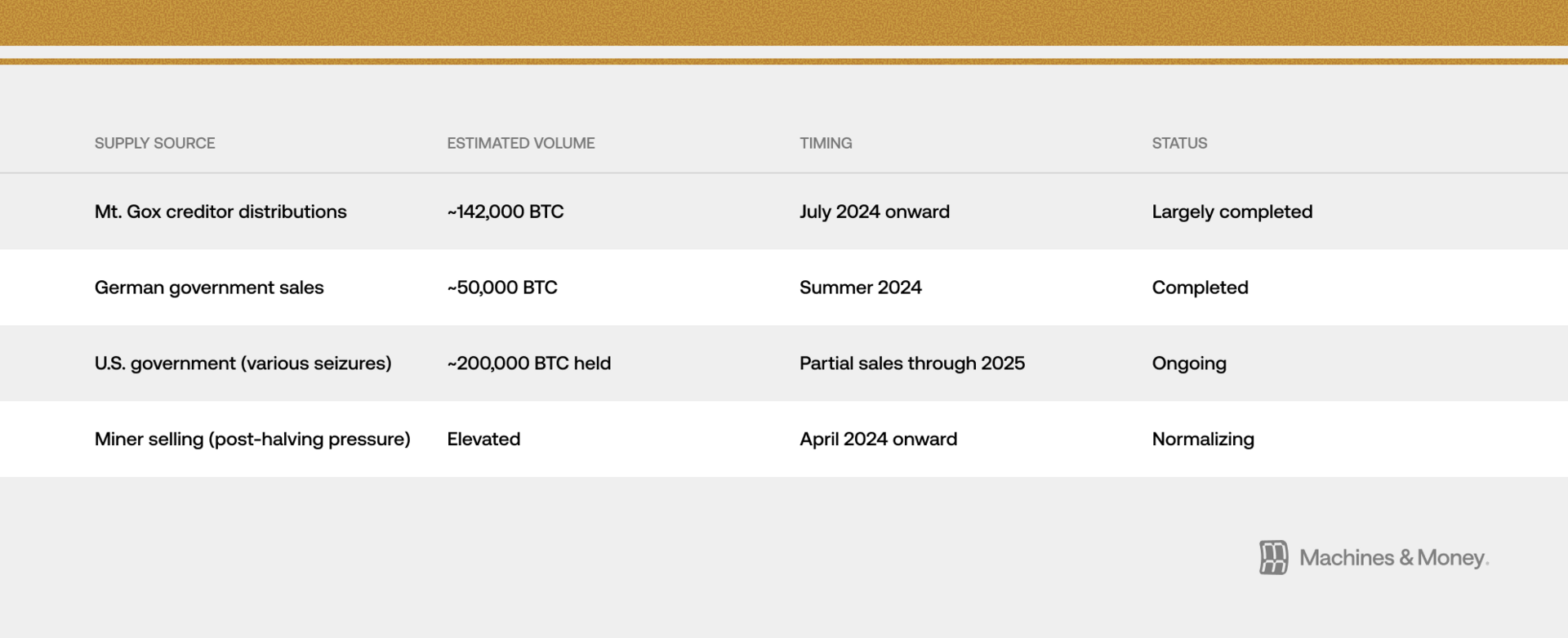

6. Crypto-Specific Supply Overhang

Several crypto-specific factors created selling pressure independent of macro conditions.

Mt. Gox creditor distributions added approximately 142,000 BTC to circulating supply starting in July 2024 and continuing through 2025. These coins went to holders who received Bitcoin at effectively zero cost basis, creating natural sell pressure.

The German government liquidated approximately 50,000 BTC seized from criminal operations during summer 2024.

U.S. government holdings from various enforcement actions total approximately 200,000 BTC, with partial sales occurring at irregular intervals.

The April 2024 halving reduced block rewards from 6.25 to 3.125 BTC, but historical patterns suggest halving effects operate on a 12 to 18 month lag. This would have placed a potential supply-driven rally in the April to October 2025 window.

That window has now passed without a sustained rally materializing, which presents a challenge to the halving thesis. Previous halvings (2012, 2016, 2020) all saw significant price appreciation within this window.

The 2024 halving's failure to produce similar results by October 2025 suggests either the effect is delayed beyond historical norms, or the halving's impact is diminishing as Bitcoin's market structure matures and block rewards become a smaller percentage of total supply.

The countervailing signal: exchange balances declined through the year, which typically indicates accumulation by long-term holders. Stablecoin market cap grew approximately 52% in 2025 (from $205 billion to $311 billion), representing substantial dry powder that could fuel a rally if sentiment shifts (CoinGecko, DeFiLlama).

In 2025, this liquidity entered the crypto ecosystem but remained parked in stablecoins rather than rotating into Bitcoin.

The Steel Man: What If Bitcoin Bulls Are Right?

Any honest analysis must engage with arguments against its thesis.

Three counter-arguments deserve serious consideration.

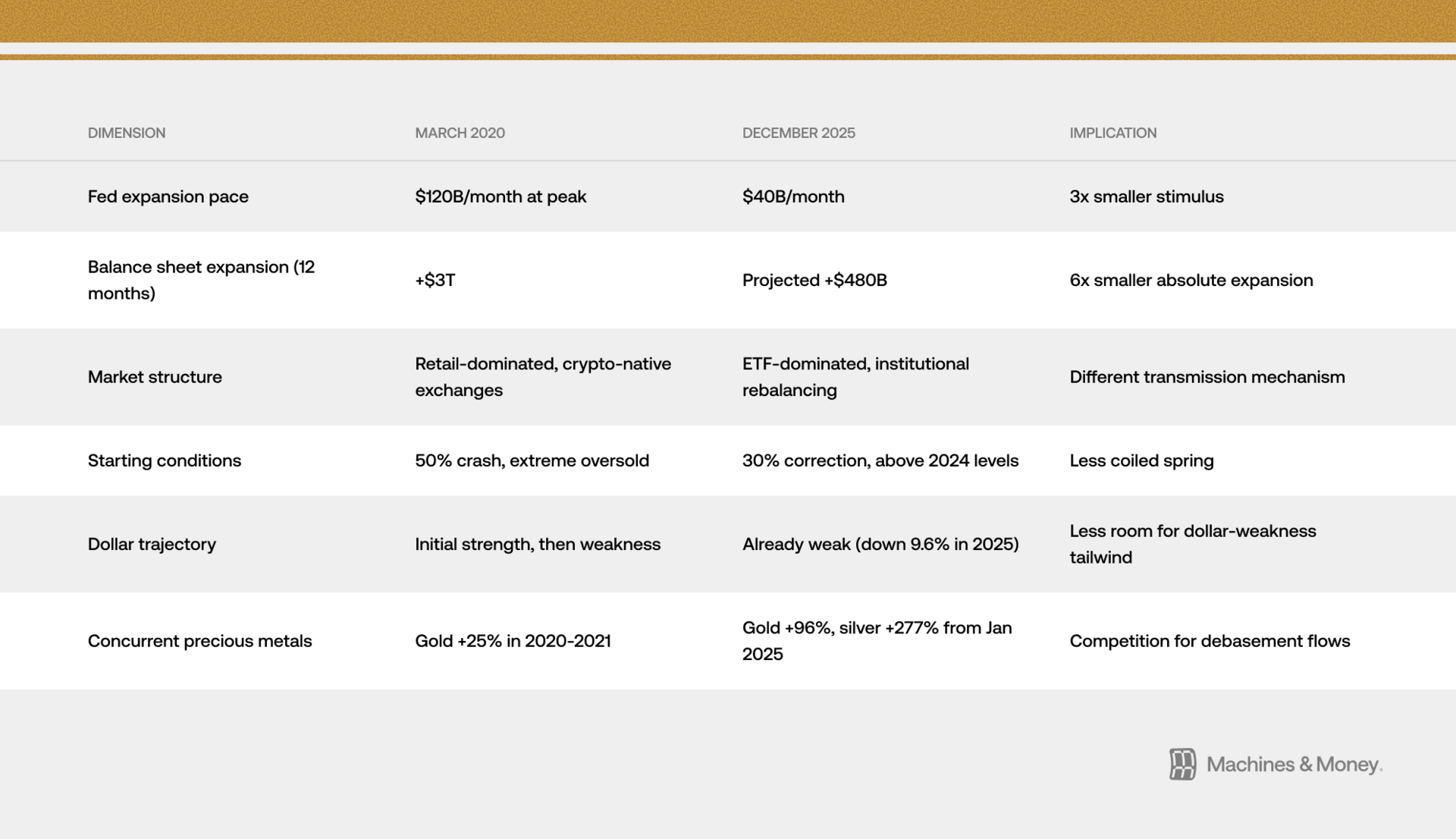

The 2020 Precedent

In March 2020, Bitcoin crashed 50% alongside risk assets during the initial COVID panic. It then rallied over 300% in the subsequent twelve months as the Fed's balance sheet exploded from $4 trillion to $9 trillion. Gold gained only 25% over the same period.

If you bought Bitcoin at the March 2020 low and held through 2021, you dramatically outperformed any other debasement hedge. The lag between Fed easing and Bitcoin's response was roughly two months.

Could 2025-2026 follow the same pattern? The Fed resumed balance sheet expansion in December 2025. If Bitcoin responds with a similar lag, the rally might not begin until February or March 2026. The current underperformance could simply be the painful waiting period before Bitcoin catches the debasement bid.

However, structural differences from 2020 deserve quantification.

The honest assessment: if the 2020 pattern repeats, Bitcoin could rally significantly in H1 2026. But the structural differences suggest the magnitude of response may be smaller, and the lag may be longer.

The 3x smaller pace of expansion is particularly relevant if there is a threshold effect in Bitcoin's response to monetary stimulus.

One Year Does Not Invalidate a Multi-Decade Thesis

The "digital gold" thesis is not a claim about twelve-month returns. It is a claim about Bitcoin's structural properties: fixed supply, censorship resistance, and portability advantages over physical gold. These properties do not change based on 2025's price action.

Gold itself was a poor inflation hedge in the 1980s and 1990s, losing value in real terms for two decades while inflation eroded purchasing power. Gold's modern safe-haven status was established through institutional adoption that took generations. Bitcoin has existed for fifteen years.

Judging Bitcoin's store-of-value properties based on one year of underperformance commits the same error as judging gold based on 1982's performance.

The thesis operates on different timescales than annual returns.

This argument is valid but cuts both ways. If one year of underperformance does not invalidate the thesis, one year of outperformance (2020-2021) should not validate it either. The sample size for Bitcoin's behavior during monetary expansions is exactly two (2020 and 2025), and they tell opposite stories.

Both bulls and bears are operating on insufficient data to draw statistical conclusions.

The Framing Problem

The piece judges Bitcoin against the "digital gold" benchmark, but this may be the wrong benchmark entirely.

If Bitcoin's actual value proposition is regime change insurance rather than garden-variety debasement hedging, then 2025 was not a test of the thesis. Debasement in 2025 was controlled, gradual, and institutionally managed. Central banks debased currencies while maintaining the appearance of order. Gold thrives in that environment.

Bitcoin's unique properties (seizure resistance, borderless transfer, censorship resistance) become valuable in a different scenario: politicized or chaotic debasement, capital controls, currency crises, or confiscatory policies.

None of those conditions materialized in 2025.

A key assumption in this scenario is that institutional portfolio mechanics would not dominate price action during a genuine regime crisis. This could occur if retail and sovereign flows overwhelm institutional rebalancing, or if the specific nature of the crisis (capital controls, asset freezes, currency collapse) forces institutions to reconsider their classification of Bitcoin from speculative asset to strategic hedge.

Whether this behavioral shift would actually occur remains untested.

Under this framing, comparing Bitcoin to gold in 2025 is like comparing fire insurance to flood insurance during a flood year and concluding fire insurance does not work. The comparison is valid only if you believe the two assets hedge the same risk.

Falsifiability Conditions for the Regime Change Thesis

The risk with the "regime change insurance" framing is that it becomes unfalsifiable.

If Bitcoin can always claim "the right conditions haven't arrived yet," the thesis provides no actionable guidance.

For analytical rigor, observable conditions that would falsify the thesis must be specified.

The regime change insurance thesis would be falsified if:

A genuine regime-level crisis occurs (capital controls imposed by a major economy, currency crisis in a G10 nation, widespread asset confiscation) and Bitcoin fails to outperform gold during that crisis.

Bitcoin's unique properties become compromised through successful regulatory action that effectively prevents its use as a censorship-resistant store of value in major jurisdictions.

A superior alternative emerges that offers equivalent seizure resistance and portability with materially lower volatility, and Bitcoin fails to adapt.

Over a full market cycle (7 to 10 years) that includes at least one regime-level stress event, Bitcoin fails to outperform gold on a risk-adjusted basis.

Until one of these conditions is met, the thesis remains untested rather than validated.

Investors must decide whether they are willing to hold an asset whose primary value proposition may never be tested in their investment horizon.

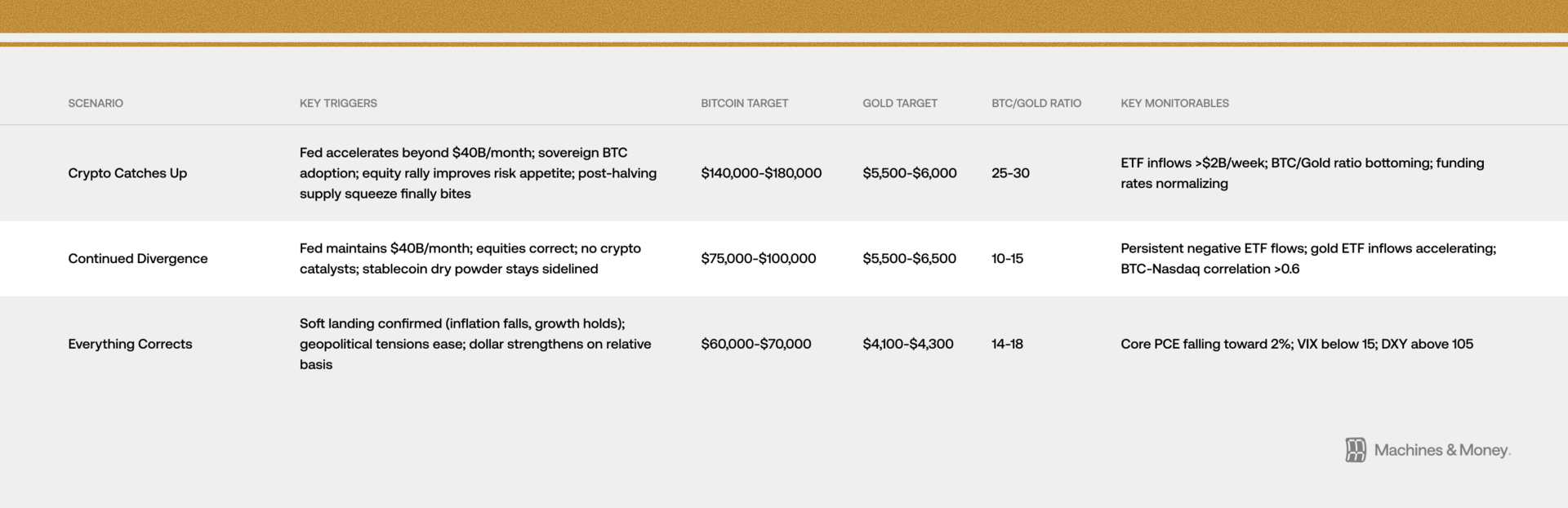

The Fork in the Road: Three Paths for 2026

Scenario 1: Crypto Catches Up

Triggers:

Fed accelerates balance sheet expansion beyond $40 billion monthly

Major geopolitical shock drives safe-haven demand to all alternatives simultaneously

Equity markets rally, improving risk appetite and lifting Bitcoin's correlation-driven returns

Sovereign nation announces Bitcoin reserve allocation

The post-halving supply squeeze that failed to materialize in 2025 finally takes hold as miner selling exhausts.

Price targets:

Bitcoin $140,000 to $180,000 by year-end 2026, representing 60 to 100% upside from current levels

Gold continues to $5,500 to $6,000 as the debasement trade broadens

BTC/Gold ratio recovers from 17 ounces to 25 to 30 ounces.

A note on geopolitical triggers: geopolitical shocks in 2025 drove flows to gold, not Bitcoin. For a future shock to benefit Bitcoin, it would likely need to involve capital controls, currency crises in major economies, or seizure risk that specifically highlights Bitcoin's unique properties versus gold's.

A generic risk-off event would likely repeat the 2025 pattern of gold outperformance.

Scenario 2: Continued Divergence

Triggers:

Fed maintains cautious $40 billion monthly pace

Equities enter correction, dragging Bitcoin lower given persistent correlation

Precious metals continue outperforming on safe-haven flows as the parabolic move extends

No major crypto-specific catalysts materialize

Stablecoin dry powder (now over $310 billion) remains parked rather than rotating into Bitcoin.

Price targets:

Bitcoin range-bound between $75,000 and $100,000, with periodic rallies failing at resistance

Gold extends toward $5,500 to $6,500 per ounce. Silver volatility increases with potential for both $130+ and sharp corrections

BTC/Gold ratio drifts lower toward 10 to 15 ounces.

This scenario is essentially the current trajectory extended. Gold and silver are already accelerating in January 2026 while Bitcoin flatlines.

Unless something changes the dynamics described in Part 3, this path remains the default.

Scenario 3: Everything Corrects

Triggers:

This scenario requires the removal of conditions driving the debasement trade, not merely a hawkish Fed. The path would involve inflation falling rapidly while growth remains solid (a "soft landing" that seemed unlikely but could materialize if supply chains normalize and energy prices stabilize)

Simultaneously, geopolitical tensions ease materially, removing the fear bid that has supported gold. The Fed holds rates higher for longer, but markets interpret this as confidence in the economy rather than policy error

The dollar strengthens as a relative safe haven as EU fiscal concerns and Japan's bond market stress make alternatives less attractive.

In this environment, gold loses both its monetary debasement thesis (inflation falling removes urgency) and its crisis hedge thesis (geopolitical calm removes fear bid).

Bitcoin falls on dollar strength and the removal of liquidity expansion expectations.

Price targets:

Bitcoin falls to $60,000 to $70,000, testing 2024 support levels

Gold corrects 15 to 20% from current $5,090 levels to $4,100 to $4,300

Silver corrects 30% or more given its parabolic January 2026 move, potentially returning to $70 to $80.

This is the lowest-likelihood scenario because it requires multiple conditions to reverse simultaneously.

The structural fiscal deterioration in major economies makes sustained dollar strength difficult, and geopolitical tensions show no signs of easing.

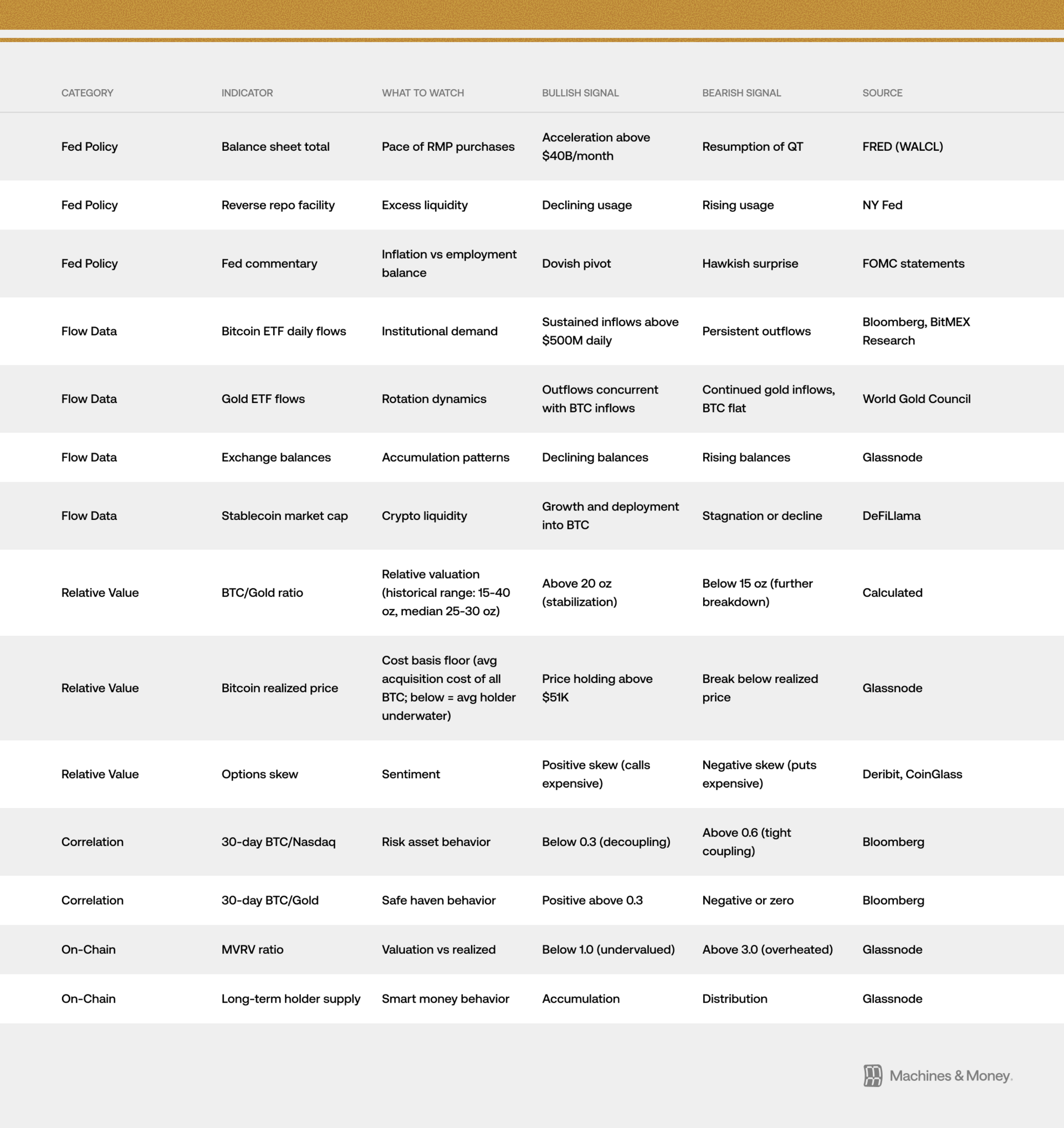

The Scoreboard: How to Know Which Scenario Is Winning

Current readings as of January 27, 2026: The BTC/Gold ratio at 17 ounces is closer to the bearish threshold (below 15 oz) than the bullish threshold (above 20 oz). Gold ETF inflows continue while Bitcoin ETF flows have been mixed. The correlation between Bitcoin and Nasdaq remains elevated.

These readings collectively suggest Scenario 2 (Continued Divergence) is the current trajectory.

The Verdict: Right Tool, Wrong Phase?

The debasement trade is real and unfolding as theory predicts. Monetary expansion has resumed, fiscal trajectories are deteriorating, and confidence in fiat stability is weakening.

Precious metals responded immediately and emphatically, with gold breaking $5,000 for the first time and silver surging above $110 in January 2026, signaling that the trade may be accelerating rather than maturing.

Bitcoin's failure to participate in 2025, now extending into 2026, does not necessarily invalidate the debasement thesis for crypto. It clarifies Bitcoin's conditionality. Bitcoin is not a hedge on present-day debasement. It is a hedge on future regime instability.

It requires not just monetary expansion but also rising risk appetite, crypto-specific catalysts, and ideally some combination of dollar crisis, capital controls, or sovereign adoption to unlock its safe-haven properties.

The structural factors identified in this analysis (volatility, central bank endorsement gap, institutional portfolio mechanics) predict persistent underperformance relative to gold in "normal" debasement environments.

The cyclical factors (correlation regime, post-halving dynamics, supply overhang) leave room for a 2026 reversal if conditions shift, though the failure of the halving to produce typical results within the historical window is a cautionary signal.

The central question for 2026 is not whether debasement continues. It almost certainly will. The question is whether the nature of that debasement changes.

If debasement remains controlled, gradual, and institutionally managed, precious metals will likely continue outperforming. Gold thrives when central banks debase currencies while maintaining the appearance of order. The January 2026 acceleration in both gold and silver suggests this trade has room to run.

That describes current conditions.

If debasement becomes politicized, chaotic, or confiscatory, Bitcoin's unique properties become invaluable. An asset that cannot be seized, frozen, or inflated away by government decree has obvious utility in that scenario. But that scenario is not the base case for 2026.

The honest conclusion is that precious metals won 2025 because they were the right tool for the current phase of debasement.

Bitcoin may prove to be the right tool for a later phase that has not arrived yet.

The risk for Bitcoin holders is that the later phase never arrives, or arrives only after prolonged underperformance destroys confidence in the thesis.

The small sample size problem remains: we have exactly two data points for Bitcoin's behavior during major Fed easing cycles (2020 and 2025), and they tell opposite stories.

Anyone claiming certainty about what happens next is simply overconfident.

Sources

Federal Reserve Bank of New York, "Statement Regarding Reserve Management Purchases Operations," December 10, 2025

Congressional Research Service, "The Federal Reserve's Balance Sheet," IF12147, December 2025

Committee for a Responsible Federal Budget, "Interest Costs Surpass $1 Trillion," FY 2025 analysis

Peterson Foundation, federal interest cost data

World Gold Council, "Gold Demand Trends Q3 2025" and "Central Bank Gold Statistics," various dates

LBMA Gold Price and Silver Price, daily fixings

BullionVault year-end price data and returns calculations

Silver Institute, "World Silver Survey 2025"

Shanghai Gold Exchange, spot silver prices

CoinDesk Bitcoin Price Index

dqydj.com Bitcoin Returns Calculator

First Trust Advisors, "The S&P 500 Index 2025 Recap"

RBC Wealth Management, "U.S. Equity Returns in 2025"

Nasdaq Index Research monthly reports

Glassnode on-chain analytics

CoinGlass derivatives data

CME Group, "Cryptocurrencies and Equities: A Shifting Correlation Landscape," May 2025

BlackRock/iShares, "Bitcoin & Ethereum ETP Landscape Report," January 2025

NYDIG, "Q1 2025 Volatility Analysis"

CNBC market data, April 2025

LiteFinance gold price data, 2025

Farside Investors, Bitcoin ETF flow data

CoinGecko, "2025 Annual Crypto Industry Report"

DeFiLlama, stablecoin market cap data

GlobalData, Mexico mining production statistics

U.S. Mint, gold coin production reports

Arkham Intelligence, government Bitcoin holdings tracker